ev charger tax credit 2020

Learn How ChargePoint EV Charging Will Benefit Your Business And Produce ROI. For tax years beginning before January 1 2020 a tax credit is available for up to 75 of the cost of installing commercial alternative fueling infrastructure.

Solaredge Smart Ev Charger For Homeowners And Business Read

You did not verify it properly.

. Use this form to figure your credit for alternative fuel vehicle refueling property you. Apply today with FLO. As it currently stands the credit will apply to any EV charging installation work through December 31.

The credit amount will vary based on the capacity of the battery used to power the. It is not yet known if this credit will be extended for any chargers installed in 2022. Fueling station owners who install qualified equipment at multiple sites are allowed to use the credit towards each location.

Just buy and install by December 31 2021 then claim the credit on your federal tax return. EV charging stations purchased in 2018 through the end of 2020 are now eligible for a 30 tax credit for purchase and installation costs up to 1000 dollars for residential installations and up to 30000 for commercial installations. Electric vehicle charging rebates are available for your workplace.

This incentive covers 30 of the cost with a maximum credit of up to 1000. How long is the US federal tax credit for EV chargers good for. Permitting and inspection fees are not included in covered expenses.

Federal EV Charger Incentives. For tax years beginning before January 1 2020 a tax credit is available for up to 75 of the cost of installing commercial alternative fueling infrastructure. Several states and local utilities offer electric vehicle and solar incentives for customers often taking the form of a rebate.

It already expired once in 2016 but was extended by the government through December 31 2020. Ad Get up to 150000 per DC fast charger to install EV charging stations in New Jersey. Federal Tax Credit Up To 7500.

To receive the federal tax credit for installing an EV charger in your home you must purchase and install the charger by December 31 2021. Alternative Fueling Infrastructure Tax Credit State EV Charging Incentive. Tax credits are available for EV charger hardware and installation costs.

As of February 2022 residents in any state can get an income tax credit to help defray the cost of both EV chargers and EV charger installations. This importantly covers both components on charging. The full phase-out already occurred for GMs Chevrolet Bolt Volt and Cadillac CT6 Plug-in and ELR for example with these EVs becoming ineligible for the credit after the end of March 2020.

You have a sub-routine which limits the total amount contrary to the law. The AFITC is a time-limited EV charging tax credit. Eligible alternative fuels include natural gas propane and electricity.

This tax credit helps subsidize the installation costs of residential charging and commercial charging stations. Alternative Fuel Infrastructure Operator. Right-to-Charge Other Incentive Other Regulation User All.

However I cant find any evidence of this being valid past 123121. You might have heard that the federal tax credit for EV charging stations was reintroduced recently. Earned Income Tax Credit.

All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. It covers 30 of the costs with a maximum 1000 credit for residents and 30000 federal tax credit for commercial installs. The federal government offers a tax credit for EV charger hardware and EV charger installation costs.

I set the car to zero and it showed me the charger. You may be eligible for a credit under Section 30D a if you purchased a car or truck with at least four wheels and a gross vehicle weight of less than 14000 pounds that draws energy from a battery with at least 4 kilowatt hours and that may be recharged from an external source. Tax Incentives Registration or Licensing Fuel Taxes Loans and Leases Fuel Production or Quality Rebates Renewable Fuel Standard or Mandate.

The new bill would look to reinstate up to 7000 in tax credits for these EVs. Alternative Fueling Infrastructure Tax Credit State EV Charging Incentive. Consumers who purchase qualified residential fueling equipment prior to December 31 2021 may receive a tax credit of up to 1000.

2020 to December 31 2022. Form 8911 is used to figure a credit for an alternative fuel vehicle refueling property placed in service during the tax year. Ad 97 of electric vehicle drivers charge at home or work.

Heres how to claim your credit for 30 of the cost of your home charger and installation up to 1000. The Alternative Fuel Vehicle Refueling Property Tax Credit or 2020 30C Tax Credit provides tax relief for businesses that install refueling properties such as EV charging stations and applies retroactively to any costs associated with. EV charging infrastructure rebates available in New Jersey.

Carpool lane access and reduced rates for electric vehicle charging. Install costs can account for the majority of the total cost of installing EV charging especially for commercial installations. State tax credit equal to the lesser of 35 of.

It covers 30 of the costs with a maximum 1000. The credit attributable to depreciable property refueling property used for business or investment purposes is treated as a general business credit. Businesses and Self Employed.

January 1 2023 to December 31 2023. The federal government offers a tax credit for EV charger hardware and EV charger installation costs. The AFITC Is Expiring at the End of 2020.

Federal tax credit gives individuals 30 back on a ChargePoint Home Flex EV charger and installation costs up to 1000. The important thing is not to overlook incentives for buying the EV charging station which is a critical component of a convenient and enjoyable EV ownership experience. You must have purchased it.

Entered both the car and charger and it only showed me the car. Personal Vehicle Owner or Driver. Ad Incentives Subscription Pricing Make EV Charging With More Affordable Than Ever.

If I modify the car to something less like 600000 then it shows me both. This information does not constitute tax advice and cannot be used to avoid tax penalties. Eligible alternative fuels include natural gas propane and electricity.

Us Ev Charging Network Could Finally Become Universal Protocol

Guide To Home Ev Charging Incentives In The United States Evolve

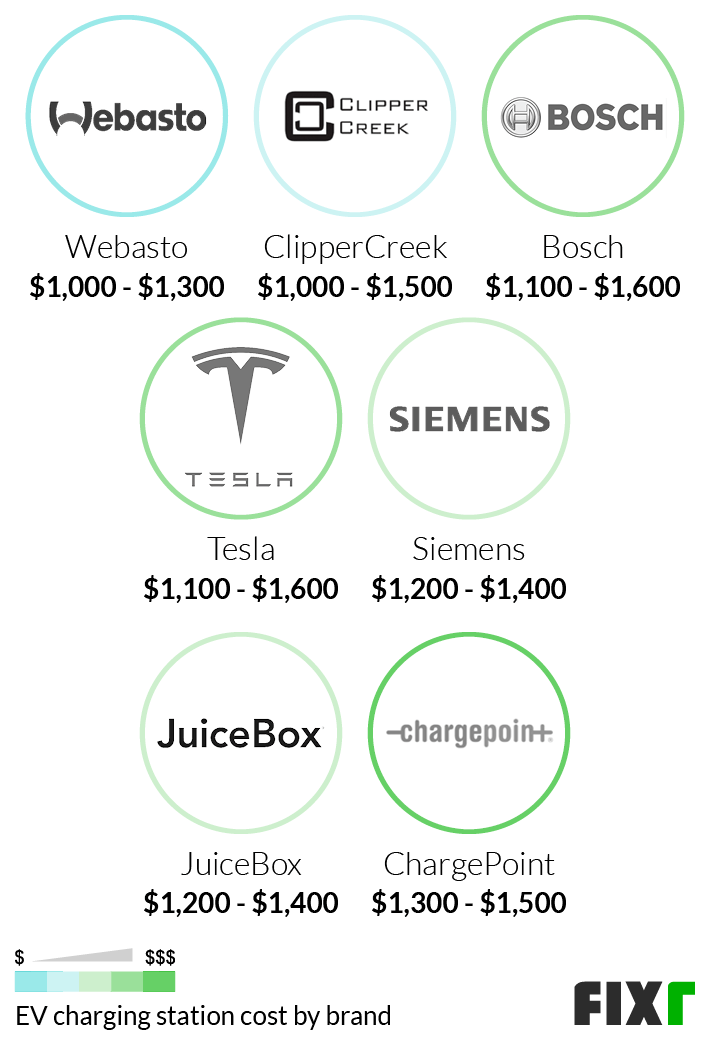

2022 Cost To Install Ev Charger At Home Electric Car Charging Station Cost

How To Claim Your Federal Tax Credit For Home Charging Chargepoint

How To Get More Level 2 Ev Charging Flexibility Without Costly Electrical Work

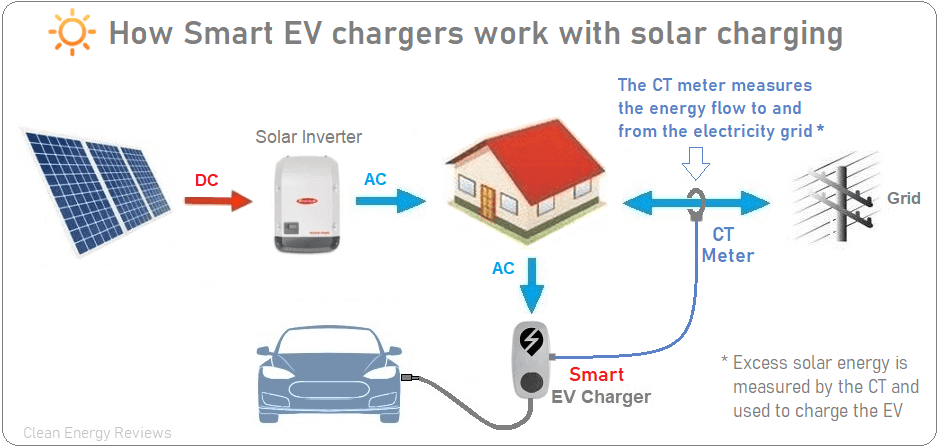

Best Smart Electric Vehicle Chargers Clean Energy Reviews

How To Claim Your Federal Tax Credit For Home Charging Chargepoint

New Ev Charging Station In Sanford Florida 充電器

Do I Have To Pay To Charge My Electric Car Autotrader

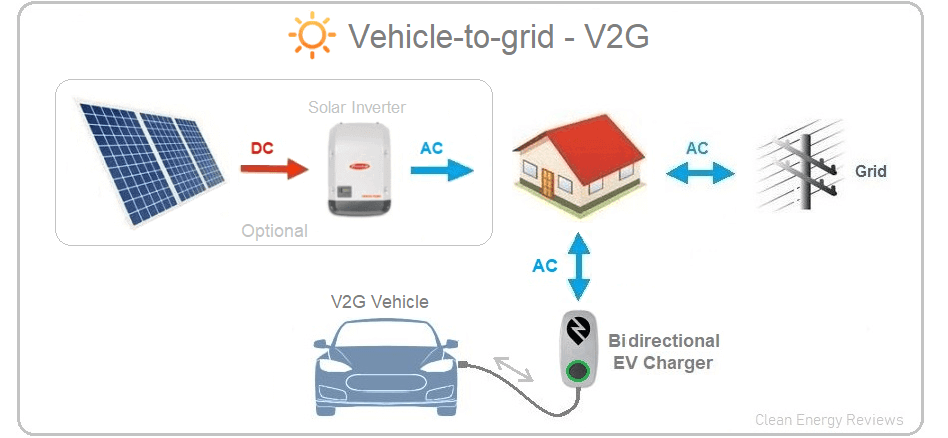

Bidirectional Chargers Explained V2g Vs V2h Vs V2l Clean Energy Reviews

4 Things You Need To Know About The Ev Charging Tax Credit The Environmental Center

Ev Charging Speeds Charging Levels And Charging Stations What S The Difference Smart Electric Vehicle Ev Charging Stations

Ev Charging Stations For Dealerships Enel X

Electric Car Chargers Ev Charging Stations Evse Smart Charge

Tax Credit For Electric Vehicle Chargers Enel X

Solaredge Smart Ev Charger For Homeowners And Business Read

2022 Electric Vehicle Ev Charging Rebates Incentives

Rebates And Tax Credits For Electric Vehicle Charging Stations

Charging Station Safety Electric Vehicle Charging Station Ev Charging Stations Charging Station